14.OWNING THE WORLD

by theknownothinginvestor

When you don’t know what stock to pick it´s better to have them all. It’s really easy and less time-consuming. Owning the world resembles like this:

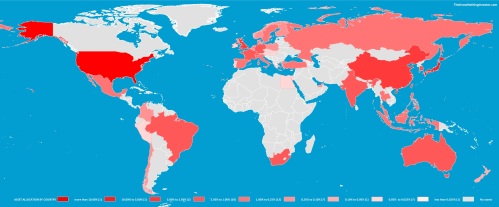

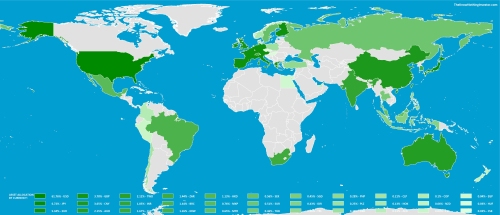

As expected US represents 62% of my portfolio and the rest of the world 48% (7% Japan, 4% UK, 4% China, 2% Australia, 2% Taiwan, 2% India, 2% Switzerland, 2% France, 2% Germany, 1% Brazil to name a few ). Gold and commodities are out of the equation because their origins are from all around the globe and their intrinsic value already work as risk mitigator.

A quick visual analysis make me wonder if shouldn’t I have a Canadian ETF, after all as shown here USA plus Canada have better rate of return than USA alone. I’ll pin this thought for future memory.

The asset allocation by currency is similar, but with common european currency (Euro) surging in third place with a little more than 5%.

Coincidently or not my portfolio allocation doesn’t differ much from today’s world markets capitalization relative size, as shown here (pag. 35). The higher allocation in US is because I took into account the bond market.

It’s true that I have a big chunk of the portfolio allocated in US, but it only represents what is going on in world markets. So, in future, if I sink with US all world will sink with us. As positive thinker, while we don’t forget subprime crisis, we will be allright.

Owning assets all over world is great. Although I only own a ridiculous small fraction of it I’m sure for now that it’s my best chance to win in the markets having less risk. A true “owning the world for dummies”.

Obrigado por este depoimento. Como me revejo nele. Depois de andar 6 anos a brincar com CFD (muitas das vezes sugestão da minha corretora) e perder dinheiro (devido aos custos diários) abri os olhos e passei a uma carteira de etf, apesar de mais simples que a que propõe aqui.

No que respeita ao risco cambial, faz alguma coisa? Dos portfolios é de facto a única coisa que me incomoda, visto não sabermos muito bem como vão evoluir as moedas. Se diz que 60% do portfolio é USA significa que está bastante exposto ao EURUSD (tenho uma percentagem identica).

Muito obrigado por este trabalho e outros noutros fóruns

LikeLiked by 1 person

Obrigado eu, pelas palavras simpáticas. Se agora partilho esta informação, foi porque outros anteriormente também o fizeram comigo.

A ideia é investir a muito longo prazo, por isso o valor do par EURUSD tenderá a equivaler-se. Se o EUR valer mais compro mais activos em USD. Se o USD valer menos, os activos noutras moedas valorizam mais.

A proporção de moeda que tenho é semelhante à capitalização das bolsas mundiais.

Outra coisa simples que faço, é que mantenho a proporção de divisas na conta conforme a evolução EURUSD. No último ano tive mais USD que EUR. Actualmente estou expectante…

LikeLike

Obrigado pela resposta.

De facto, ao ler outros fóruns reparei que uma grande parte das pessoas se preocupa com a componente cambial onde também me incluo. Já li que algumas fazem esse hedge com FOREX, outras com opções, ou usam até ETF’s como o FXE. No entanto eu acredito que é preferível não o fazer com nenhum destes produtos por causa dos custos.

Então só para ver se compreendi e a titulo de exemplo:

Um portfolio onde a componente de acções tenha 50% em SPY (dólar como moeda) e os outros 50% em VGK (acções europa, EURO) estará a fazer uma cobertura quase total da variação EURUSD. É mais ou menos isso?

Sei que o VGK tem uma componente UK e Suiça que não são EURO mas é só a titulo de exemplo.

Agradecido pelo trabalho realizado e pelo impacto que teve na vida de muitas pessoas e alguns jovens como eu que com menos de 30 anos ainda tentam lutar por uma reforma quer antecipada, quer mais sorridente.

LikeLike

É isso, mais o facto de se fazer constantes conversões de EUR (a moeda com que somos pagos) para comprar activos em USD, na altura dos rebalanceamentos.

Imagina que converto EUR em USD 3 vezes por ano durante 30 anos, pegando na evolução do par EURUSD desde 1979 (cotou entre 0,63 e 1,59) e gerando compras aleatoriamente dá-me valores entre 1.09 e os 1.14, ou seja, estes devem este os preços médios do par. Se tivesse feito a carteira em 1979 e quisesse-me desfazer dela agora, a evolução do par pouco interessaria.

Contudo, no curto prazo a evolução do par pode ter um efeito devastador.

LikeLike

Não o vou maçar mais.

Agradecido pelas respostas dadas.

Votos de atingir os objetivos a que se propôs com a carteira.

LikeLike

Ora essa. Quantas mais me perguntarem mais evoluo.

PS – Na Internet não há cá vocês. 🙂

LikeLike